Types of Manhattan Property to Consider

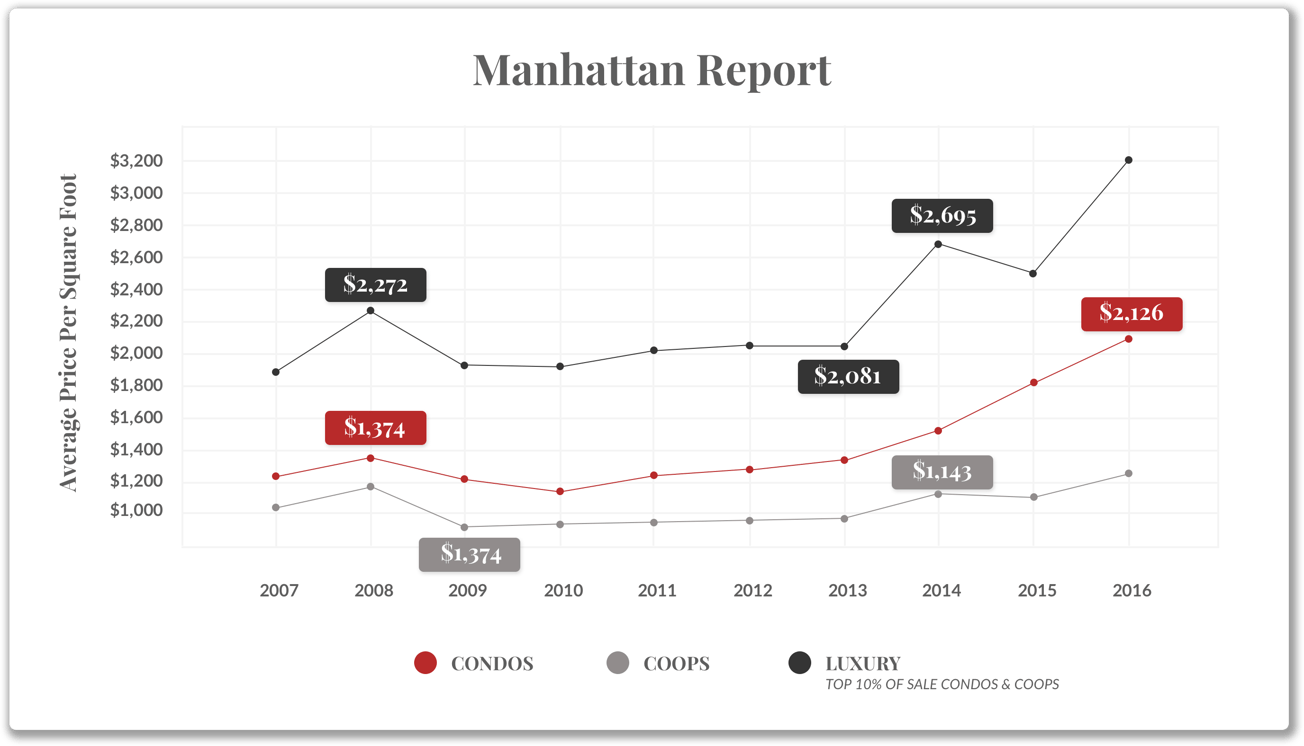

The two primary decisions buyers must make are property location and property type. We have explored why New York City, and Manhattan, are an ideal location so, now let us look at property types. Manhattan has four main types, townhouses, condominiums, cooperatives, and condops (which are a blend of condo and co-op.

- Townhouse: A New York townhouse is a multi-story, single family home. The owner holds title deed and is solely responsible for it. The owner has no restrictions imposed by an association. They are investor-friendly properties.

- Condominium or condo: a Manhattan condo owner holds title by deed of an apartment and takes joint ownership with all other owners of the common areas. A condo board manages the property and owners pay a monthly fee to cover common expenses. There are some restrictions imposed by the board, financing is accessible, and they are investor-friendly.

- Co-operative or co-op: A coop building is owned by a corporation. The corporation sells stock to shareholders in exchange for a long-term proprietary lease. Lessees pay a monthly fee to cover all costs. Co-ops have many restrictions such as on subleasing. They are not investor-friendly and usually prohibit foreign ownership. They represent about 70% of the market.

- Condop: This is a co-op with condo rules. They are investor-friendly.

Whether to buy a co op vs condo is a question we always hear. You can find more detailed information on the pros and cons co ops vs condos here.

NYC Property Buyers Should Use Their Own Buyer Broker

Every state in the US and every country in the world have different laws governing the purchase and sale of real estate. The two parties to a real estate transaction are the seller and the buyer. The seller will use a dedicated real estate selling broker or agent to represent them throughout the transaction. This selling agent or broker will work solely in the seller’s interest - getting the highest price and best terms for the seller. Accordingly, buyers should have their own dedicated representative!

In the US, all broker commissions are paid by the sellers. Then, they are split between the seller's agent and the cooperating buyer's agent. Accordingly, hiring a buyer's agent is free of charge to the buyer. The buyer's agent has a vested interest in the buyer, the buyer's goal, and in getting the best outcome for the buyer.

In contrast, the seller's agent's goal is to get the highest possible price and the best possible terms for the seller. The buyer agent's role is to work for the buyer and to get them the right property, at the right price, on the most attractive terms and with least amount of hassle. The buyer, therefore, can rest assured that they have on their team a specialist who knows:

- Everything about the Manhattan real estate market and individual neighborhoods.

- Every type of property that is currently on the market.

- Properties due to come on the market.

- Background details on each development, not just individual apartments and townhouses.

- The homeowner associations which govern the development.

The buyer's agent is crucial to achieving a totally successful purchase – of the right property, on the right terms, and with minimum hassle or any long-term regret. Buyers who are financing their purchase will want to have their mortgage application pre-approved as far in advance as possible. An offer to purchase supported by a mortgage commitment from a respected lender adds a lot of weight to the offer, especially in a city that has a lot of cash deals.

If the purchase is for a condo or co-op, the buyer must also be approved by the board. Boards can deny an application for different reasons. An experienced buyer agent will know about individual condo and coop boards. They will be able to advise their buyers on whether it is worth pursuing a particular property or to avoid the likelihood of being rejected by the board. For example, condo boards have "right of first refusal". They can decide to buy the apartment themselves from the seller instead of accepting a new buyer into the building. In contrast, coop board can flat out reject buyers. Generally, coops are for primary homeowners. Therefore, if you are a foreign buyer or investor interested in renting out their new property, you are very likely to be rejected the coop board.

The real estate broker helping the buyer will also help to decide on which attorney to hire to take the transaction through to successful completion. They also have an array of connections that can help you get a mortgage.

"9 Tips for Buying Luxury Real Estate in New York"

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)

START YOUR SEARCH NOW