Manhattan Pre-Tariff Q1 2025 Results & Early Q2 Momentum

🏙️ Manhattan Market Resilience Amid Global Trade Developments

The first quarter of 2025 marked Manhattan’s strongest performance in years—before President Trump’s sweeping tariffs were announced in early April. While market watchers have been waiting to see how the tariffs might impact demand, the data through early May confirms that the market remains steady and active, not speculative or collapsing.

📊 Q1 2025 – A Market on the Move

The first quarter of 2025 showcased a robust Manhattan real estate market, characterized by increased sales activity, rising prices, and strong demand across various segments.

Strongest Quarter in Three Years:

Nearly 2,560 closings, up 28.8% year-over-year, with improvements in sales, supply, and days on market—only the fourth time this has happened in 20 years.

Sales Outpaced Modest Supply Growth:

Listing inventory rose just 7.5%, supporting a faster pace of deals and stronger pricing.

Manhattan Luxury Real Estate Market Performance:

Price trends for the luxury segment were higher than the overall market. Sales of luxury properties (top 10% of the market) jumped 37% year-over-year, with the average luxury home price reaching $10.3 million, the highest on record. The Entry level price for Luxury was $4.4M, up 19.7% from the previous year and the price per square foot was $3,173, up 16%.

Healthy Price Metrics:

A sales mix shift to larger units, a higher share of new development sales (13% vs 9.7%; which, generally are more expensive than resales), and more higher end sales pushed price trends higher.

- Average Sales Price: $2.2 million, up 21%

- Median Sales Price: $1.17 million, up 11%

- Condo Average Sales Price: $3.1 million, up 17%

- Condo Average Price PSF: $2,130, up 10%

- New Development Average Sales Price: $3.95M, up 21.4%

- New Development Average Price PSF: $2,563, up 9%

Financing Remains Conservative

- 58% of all sales were cash deals, rising to 90% for homes priced over $3 million.

- High lending standards and low default rates continue to characterize the market.

Supply Constraints Persist

- Very low new development pipeline in Manhattan since Covid due to high materials and financing costs and regulatory hurdles.

- Government incentives like the new 485x tax abatement remains underutilized because stringent requirements and high associated costs have led to limited adoption by developers.

- Homeowners are discouraged from moving because they are locked into low mortgage rates. This reduces housing supply for sale and, ultimately, sales activity. Currently, 73.3% of US mortgage borrowers have rates below 5.0%, significantly lower than current market rates, which average around 6.76% for a 30-year fixed mortgage.

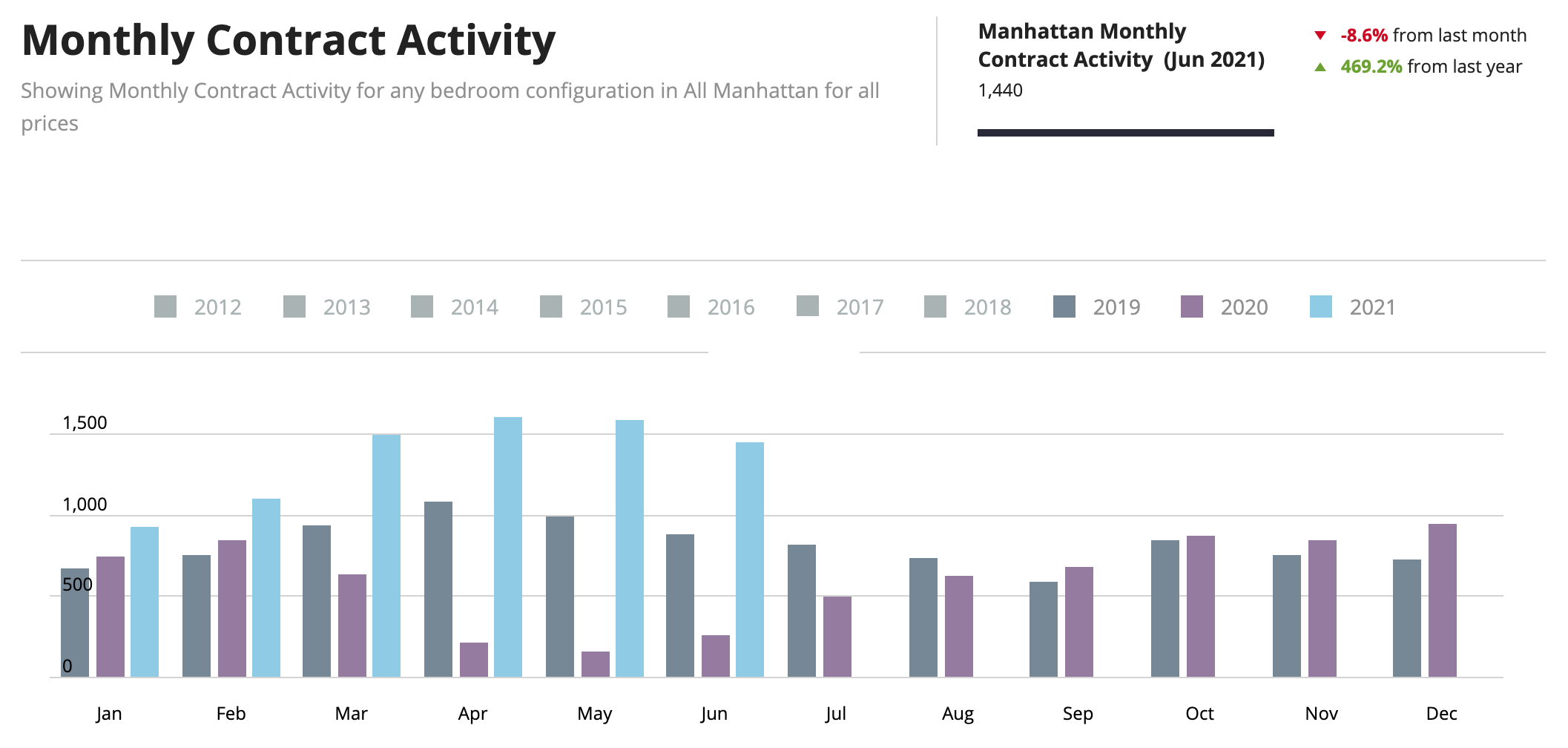

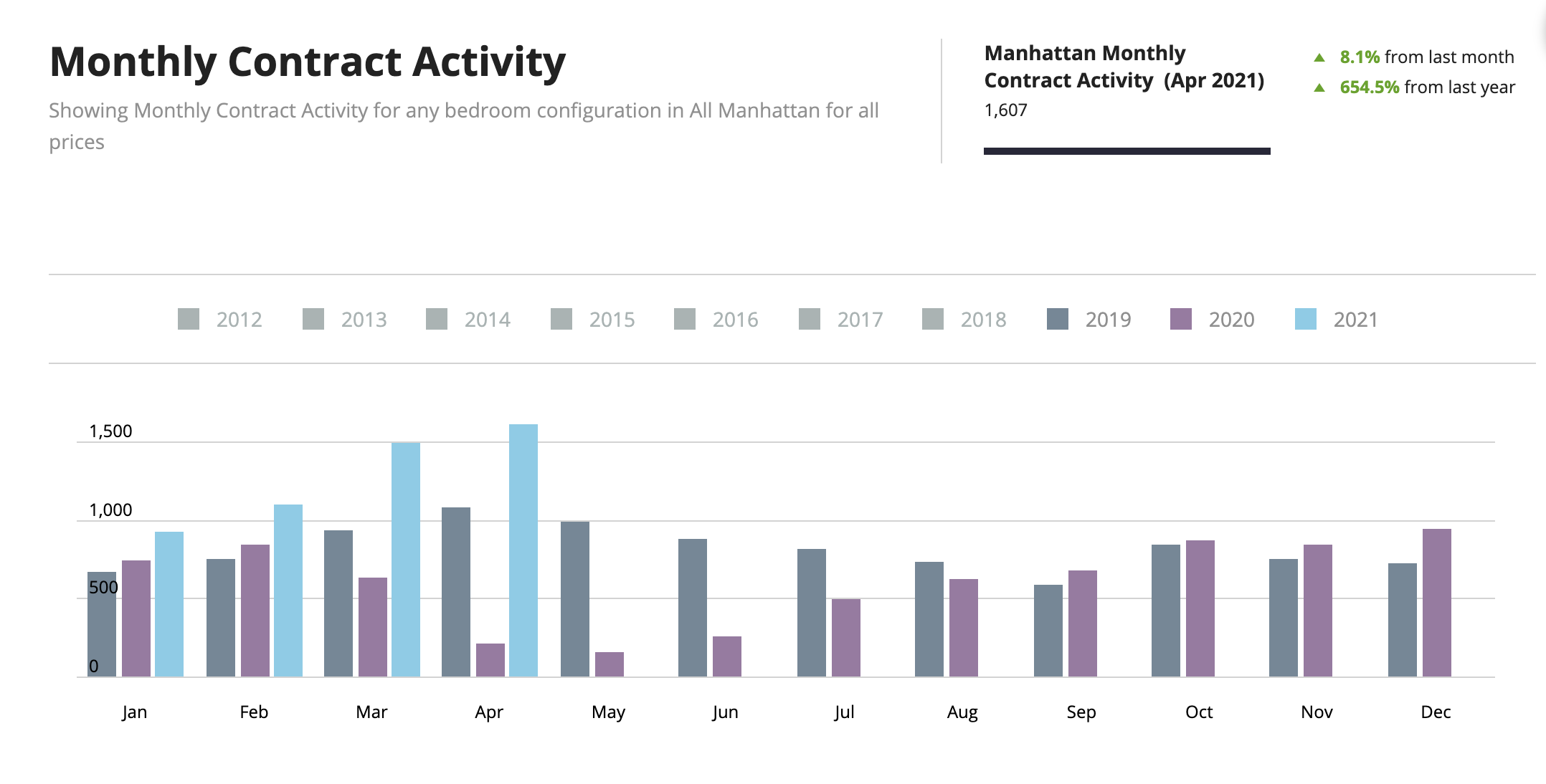

📈 April 2025 – Manhattan Market Held Strong Even After Tariff Announcement

April 2025 Signed Contracts were 1,150, up across the board compared to April 2024.

- All transactions: +11%

- Condos: +8%

- Co-ops: +13%

Mid Market Led Growth Compared to April 2024

- Contracts between $2M - $3M rose 24%

- Greater than $5M rose 3%

Inventory Gains Enabled Sales Activity

- Active listings rose 16% compared to March but were down 1% compared to April 2024.

🔍Early May 2025 – Manhattan Market Activity Has Been Stable

Despite the uncertainty surrounding tariffs, the first week of May recorded approximately 250 signed contracts, signaling that:

- Buyer engagement remains steady

- The market has not stalled or collapsed.

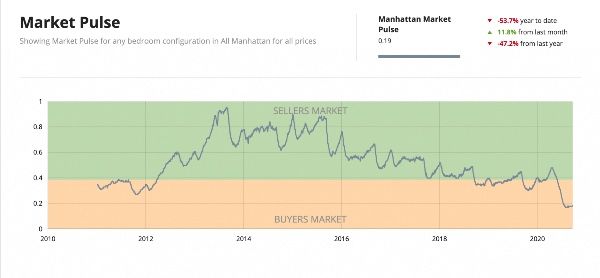

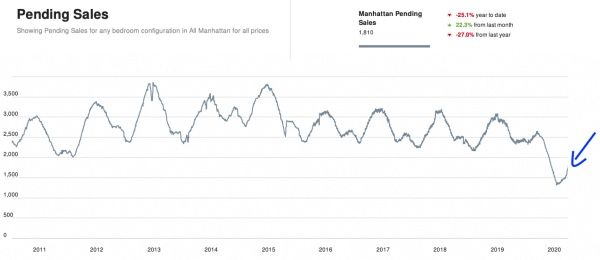

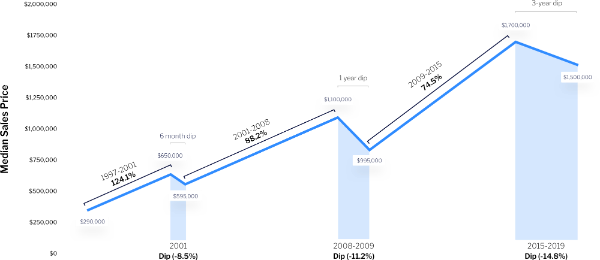

🏙️ Why Manhattan Real Estate Is Playing Catch-Up

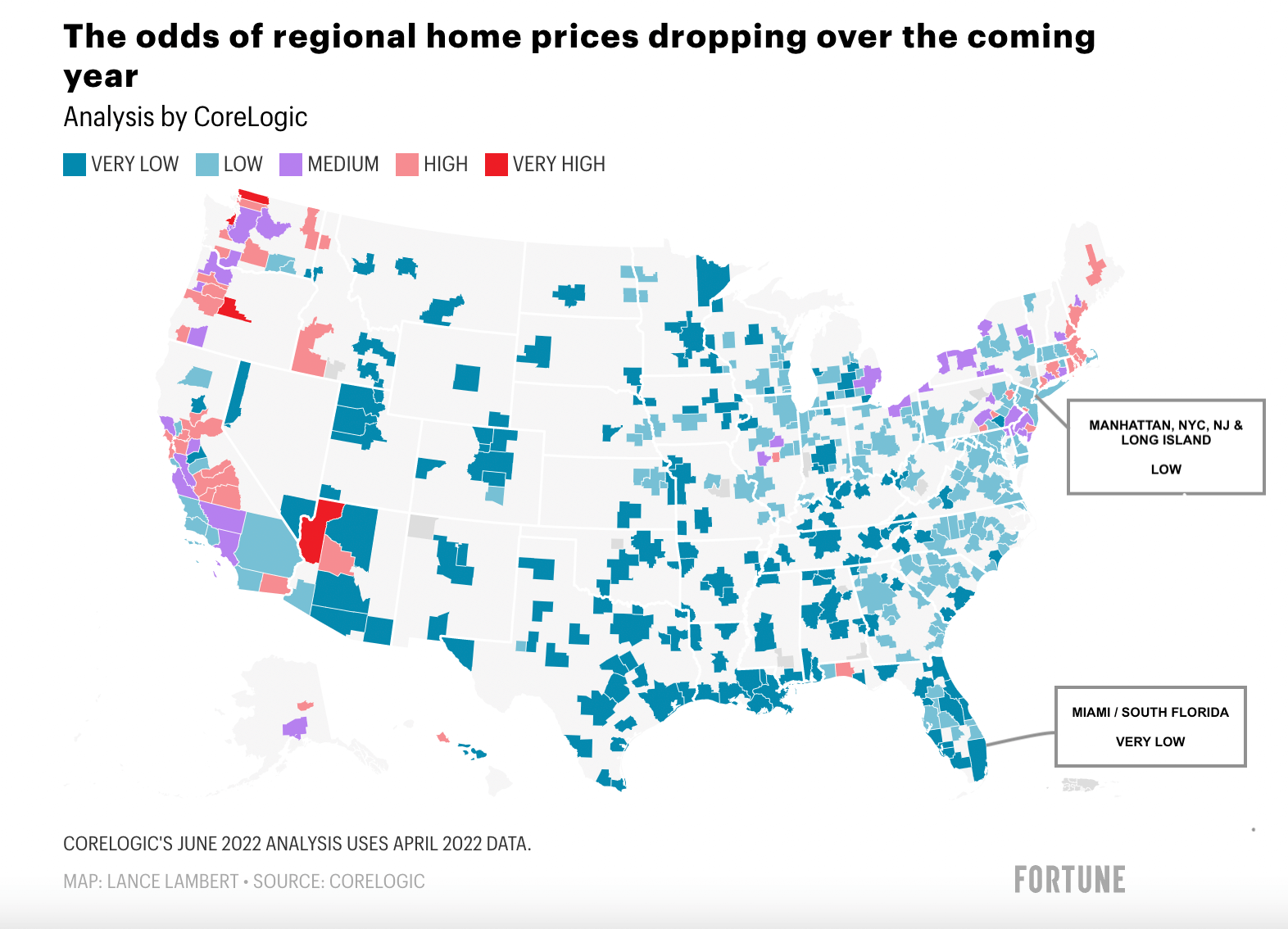

While much of the country experienced double-digit price increases during the pandemic housing boom of 2020–2022, Manhattan was an outlier. As city life paused, offices emptied, and urban migration slowed, prices in Manhattan remained relatively flat or even declined in certain segments while other U.S. markets surged. For many of those markets that shot up, we are seeing some of them deflate now, but not NYC.

What we’re seeing now in Manhattan is a rather healthy recovery as buyers have returned to the city, inventory remains tight, and prices catch up to years of suppressed growth.

🏗️ Tariff Impact on Construction Costs & Prices

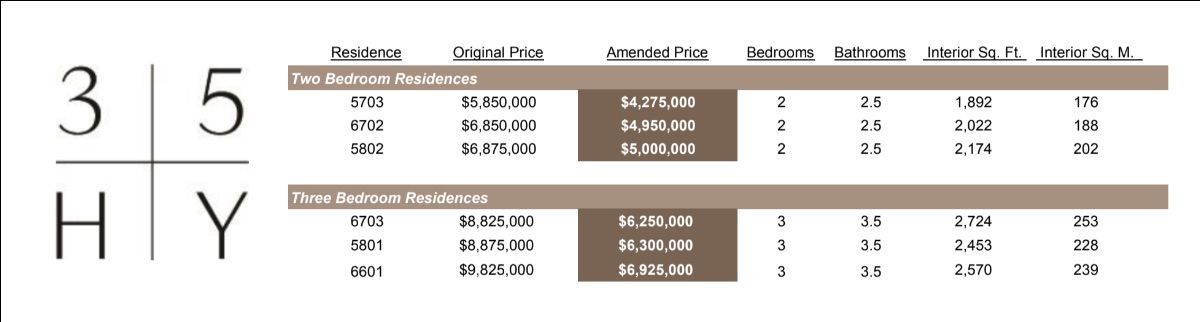

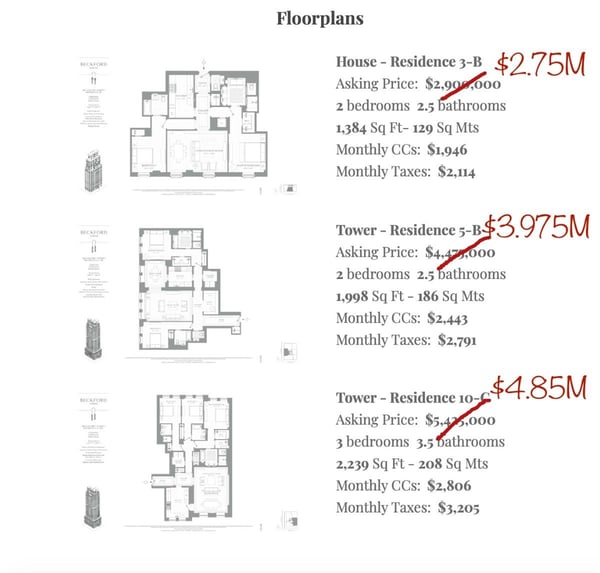

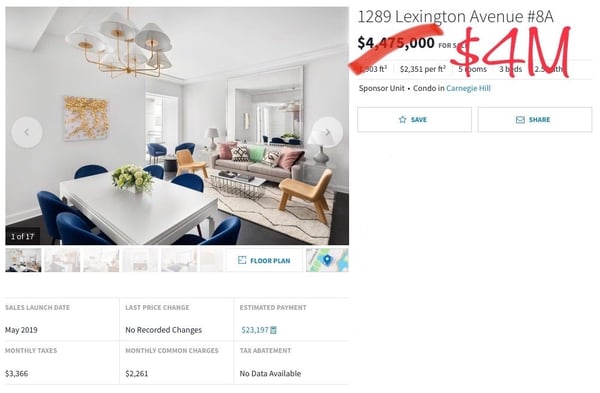

With tariffs significantly driving up construction costs, the next wave of Manhattan developments is poised to debut at much higher prices. If building costs go up 25%, a developer is not going to eat this cost, nor is China, Canada or Europe. Realistically, if they can't pass these costs on to buyers, they just won't build.

At a 25% increase in costs, all things being equal, the New Development Average Price PSF of $2,563 PSF (see above) would shoot up to $3,204 PSF for the next wave of new development. For a 2,000 sq. ft. 3-bedroom apartment, that would add $1.2 million to the price for the same exact apartment! Even if the costs went up by half of that in my example (12.5%), that would add $600K to the price.

Mortgage rates fluctuate, but offer refinancing opportunities during the life of ownership. Lower rates, however, are never going to make up the difference in price because of 10-25% tariffs. Therefore, for serious buyers, we suggest securing one of today's new developments at a much lower purchase price than what the next wave might bring. You can always refinance later...

🏡 Conclusion: The Safe Harbor of Manhattan Real Estate

Manhattan's real estate market continues to demonstrate resilience, driven by robust demand, constrained new development supply, and a significant share of cash transactions. Historically, during periods of global market volatility, investors have redirected capital toward tangible assets like prime real estate, seeking stability and long-term value. Despite current uncertainties, Manhattan enters this phase from a position of strength, underscoring its enduring appeal to investors.

- Net Population and International Migration to NYC Has Been Rising

- Inventory Remains Inadequate for Demand

- Prices Continue to Climb Across All Segments

- Hamptons and the Northeast $1M+ Markets Showing Similar Strength

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)