Investing in Real Estate

Before someone decides which is the best city to invest in real estate, they decide why they should choose real estate as opposed to stocks and bonds, for example. In this article we will discuss the why and the where to help our many current clients, and our future clients, to make wise decisions and the best choices.

Making money from rental properties depends on a number of different factors. We cover investment strategy in one of our earlier blogs. Making money depends on such factors as where the property is, the type of property, its purchase price, rental income yield, and the resale price when it is time to liquidate. Yield depends on both the rent charged and the costs of ownership.

In this article we discuss which cities make a wise or a less wise choice in order to decide which are the best cities to invest in rental properties in 2019.

Boom, Gloom, or Bust: Knowing Where Matters

Most residential real estate is found in the most mature markets: North America and Europe. 44% of the total value is owned by 17% of the world's population. Asia, particularly China, is emerging rapidly as its real estate industry grows. Interestingly, China's residential real estate growth is primarily caused by government policy to build more homes, and by selling vacant land to developers.

In many countries, government policy has a major impact on growth as well as on contraction. This implies that a long-term strategy for sustained asset growth is no longer a case of sitting out a natural market cycle. Governments are affecting real estate markets like never before. Some to the benefit of investors, and some not so much. This is particularly important for investors who are not citizens of a particular country. The IMF studied the world real estate market and determined that of the 57 national economies studied:

- 18 saw real estate values fall during the financial crisis of 2007-12, and they have continued to decline ever since.

- 18 saw housing markets fall sharply but have rebounded since 2013.

- 21 saw a modest price drop, but they also saw a quick recovery.

Within certain countries, as mentioned above, some cities have prospered more than others. To take a clear example, Beijing has seen a 25% annual increase because of government land sales, but Xian has seen less than a 10% rise (adjusted for inflation.) Many of the new developments will be taken by renters, not buyers. How the government may regulate rental agreements and taxation on rental income, therefore yield, is unclear.

In Europe, cities such as London, Munich, Amsterdam, Oslo, and Vienna have seen rapid real estate price increases that have far outpaced national averages. These increases seem to be because supply has not kept up with demand. When supply does catch up and surpasses demand, as is common in real estate, those investors who bought during the boom years may well see the value of their assets fall back more than they would like. Rental income is likely to be lucrative until supply catches up, and renters can afford to become buyers. Over-priced markets always see a correction, so resale prices may be disappointing in such cities.

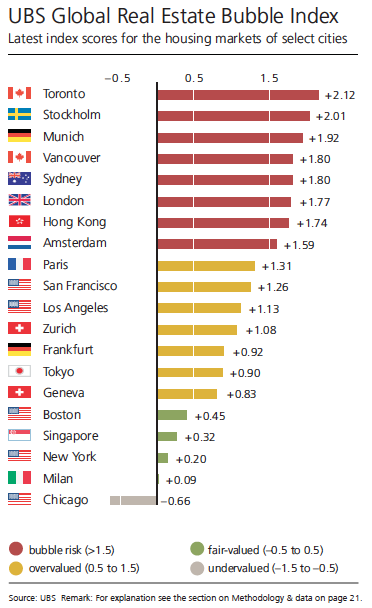

Some North American cities, such as San Francisco and Los Angeles, have seen prices outpace incomes to such an extent, that those values do not look so safe in the long term. A point to note is that a study by UBS Wealth Management listed several cities in the riskiest territory for signs of a real estate bubble.

These cities include Hong Kong, Munich, Toronto, Vancouver, Amsterdam, and London. Prices in these cities have risen an average of almost 35% over the last 5 years, while other major cities saw a 15% increase. Investors who own in these cities may consider it wise to liquidate before any bubble bursts and move their liquidated capital to a safer location.

National and international regulators are more vigilant than before about putting a check on boom periods. Their "macroprudential policies" are being used to tame the growth. Countries in the bullet points 1. and 3. above have, say the IMF, seen the most extensive macroprudential policies. Price rises which accelerate too quickly simply price many residents out of the market, so they are forced to, or simply prefer to, rent.

Since government policies are rarely, if ever, sensitive to "the invisible hand of the market" it is likely that those countries' policies will have a greater dampening down effect than intended. This point is speculative, of course, but history does tend to repeat itself. So it may be wiser to look at countries which encourage market forces rather than government domination when it comes to long-term asset growth.

The Best Cities to Invest In Rental Properties

This survey indicates where investors, particularly non-resident investors, may choose to buy rental properties.

1. New York

New York City has a huge number of professional residents with steady, well-paying jobs. Its transport infrastructure makes in-city, regional, national, and international travel easy. It is a center for culture, the arts, dining, and entertaining in general, so it continually attracts individuals and families to come and stay. Much more job diversification than it was ten years ago and the highest number of employed people in over 50 years makes the market steady and strong, including the rental market. Because the high paying jobs in the city support property prices, investment property in New York City is considered relatively low risk.

The annual UBS Global Bubble Report revealed that once again New York real estate prices are fairly valued. UBS economists analyzed the data of 20 financial centers, of which New York, Boston, Milan and Chicago were determined not to be either fairly valued or under valued. The remaining 16 cities were either classified as either in bubble territory or over valued.

What does it mean to be fair valued? It means that the perceived value of an asset is equal to the market or actual value of the asset. In contrast, an asset bubble occurs when the price of the asset has exceeded its actual value. This can happen for a variety of reasons, such as speculation, demand and exuberance. A bubble usually starts with an increase in demand, in the face of limited supply. Speculators enter the market, further driving up demand and prices. At some point, however, demand decreases or stagnates at the same time supply increases, resulting in a sharp drop in prices. This is when the bubble bursts! You want to ensure you are out of the asset before this happens.

2. Miami

Miami is another major commercial and financial hub. The city has more foreign banks and more commercial regional offices servicing Latin American business than any other city in all the USA's southern states. Because it is the financial center for so much business, it enjoys a running supply of professionals who, like in New York, choose to rent close to their places of business than buy further away and suffer long commutes.

The commercial and infrastructure developments Miami is experiencing strongly suggest that the demand for housing and rentals will remain strong for a very long time and one of the reasons for that is population growth. Thousands of foreign immigrants flock to Florida’s sandy beaches each year, mostly from Spanish-speaking countries such as Argentina, Colombia, Mexico and Venezuela, as well as Europeans and even recently Chinese. Also, after the past years’ turmoils in Brazil’s economy, hundreds of wealthy Brazilians left the country through EB-5 visas and made Miami their primary residence city. It has the highest foreign-born population of any major city in the United States. The favorable weather plays a factor, as well as the fact that there are no state income taxes.

In the past decade Miami Real Estate transitioned to a more mature market, especially for the luxury sector that has seen accelerated two-digit growth for the last few years. With the influx of overseas investment, it doesn’t look like it is going to slow down any time soon, either. This rapid rate of growth isn’t just driven by a desire for sunshine and sweeping beaches, wealthy investors are finding it’s a safe place to keep their money too.

"Miami Apartments For Sale Are Much Less Expensive Than Other Global Cities"

The video below was shared with us by the sales team at Paramount Miami and highlights the top 10 Reasons to Invest in Miami Real Estate.

3. San Francisco

San Francisco is ranked by UBS as "overvalued" with a score of +1.44. Rents and home prices have outpaced income. While the Bay Area will continue to supply rental homes for residents there are two factors that make investors hesitate.

One is that Silicon Valley is a one-industry area. There was a "dot com disaster" in the past. Another downturn for high tech could conceivably have a negative effect on both property values and rental income.

The other factor is a more subtle one. 20 - 30% of high-end real estate sales are not publicly shared in SF. It is usual for real estate to be advertised on the multiple listing service (MLS) and across many other internet sites. It is becoming common for luxury real estate to be sold "under the radar" to avoid the world seeing which industry leaders and backers are selling up. While this could be nothing more than a desire for privacy, it could also be seen as a way for high-tech and other business leaders to discourage observers from looking too closely at their business or the local industry as a whole. Lack of transparency may not bode well for future sale prices.

4. Boston

Boston is ranked as "fair-valued" with a score of +0.45 by UBS. Luxury property prices fell by 16.7% in Q2 2018 compared to Q2 2017. The Greater Boston area has a high number of professionals who rent their homes. A recent report says the supply of available homes has not kept up with demand even though thousands of new condos have been built in the past decade.

A major problem is that the wrong sort of homes were built. They were too small. This implies poor long-term planning. One result is that many Bostonians simply moved away and suffer long daily commutes. More than 50% of those who work in Boston spend three hours a day commuting. In the cold and wet winters, this can be a serious problem.

With today's technology, people will become telecommuters and may move well away from Boston, reducing the need to rent even more. A locally-based rental property investor may be able to track micro-trends and choose exactly the right area to buy their next rental property. An overseas or out-of-state investor may prefer to focus on a broader, more stable area.

5. London

London, England has long been a great place to own rental properties. UBS now scores London +1.61 putting it well into the "Bubble-risk" category. The six main reasons for this are an over-supply of quality homes coupled to a fall in demand for them, a rise in interest rates, high stamp duties to purchase property by a corporate entity, a new capital gains tax for non-residents of between 18% and 28%, Brexit, and a fear that a hard-left-wing government will win the next election and raise taxes even higher.

Brexit caused some major businesses to leave London. Brexit caused the currency to lose 13% of its value against the US dollar, and it is feared that after the separation, the £ Sterling will fall another 12%. These factors, together, negatively impact purchases, rental yield, and resale values.

Several Asian countries are experiencing rapid economic development which positively impacts real estate prices. Government policies are also impacting the markets, in some cases to force a market correction.

6. Hong Kong

HK has long been attractive to wealthy mainland Chinese investors. UBS rated Hong Kong as overpriced, and in bubble-danger territory with a score of +2.03 (up from +1.74 in the previous UBS Report.) Hong Kong's property market is overheated and has not seen a price correction, suggesting that one will happen. The 18% price rise in 2017, coupled to the average of 8% year on year since 2012 is not thought to be sustainable.

Foreign investors suffer a 30% stamp duty on purchases. Rental income tax stands at 11.4% and gross rental yield is 2.75%. This not a high yield compared to some other cities, or to government-backed bonds. With the HK dollar being tied to the US dollar, hikes in interest rates, coupled to the other costs of purchase and ownership, could hurt foreign investors.

7. Singapore

Singapore is well-placed geographically and is a financial center. It has seen a recent price correction, so residential property is ranked by UBS as fair-value (+0.44.) Recent government macroprudential measures such as the 25% buyer stamp duty, introduced to stabilize the market, have negatively impacted foreign investors. The government also instituted at 15.1% rental income tax, contributing to a rental yield of only 2.54%. Government policies were intended to curb property prices, and they have done that. Domestic primary home buyers will benefit at the expense of both foreign buyers and those who want to invest in second and third properties.

8. Ho Chi Minh City

Saigon - HCM City has had a mixed history, but in July 2018 at the "Crisis Cycle and Investment Opportunity in the Property Market" seminar, experts said a crisis is "unlikely during the next two years" because supply is now lower than in 2017. Vietnam has previously seen a property crisis every ten years or so. The GDP is growing at the same rate as when there were previous crises, but this time the government is taking steps to dampen the market to avert any future crisis.

Among the steps are a corporate tax rate of 20%, a capital gains tax rate also of 20%, a 5% stamp tax on purchases, and a rental income tax of between 10% and 20%. And as of 2019, banks will not be able to use more than 40% of their short-term capital to provide mid to long-term loans.

The main feature of today's Ho Chi Minh City real estate market is a lack of homes for low income residents and an over-supply of high-end apartments. The Vice Chairman of the People's Committee issued a warning about a bubble, and also stated that brokers and speculators are giving false information in order to raise prices. Official statements such as these may give investors pause for thought.

9. Tokyo

Tokyo's real estate prices have increased, year on year, by about 5% in the last five years, and are overvalued according to UBS, giving it a score of +1.09. Its Q2 2018 rentals increased in all 23 wards, and it is expected that the 2008 levels will be met or exceeded by 2020 for the first time since the financial crisis. As the population ages, the small single-occupancy apartment may become less attractive. In which case, occupancy rates should fall along with rental income. Japanese inflation rates in August 2018 stood at 2.54%. Japanese taxation is fairly complex, especially for non-residents. Acquisition and disposal taxes are levied, as is a tax on rental income, and a withholding tax of 20.42% is levied before income paid over.

10. Seoul

Seoul's real estate market saw prices rise by 6.9% in 2018. To curb these rises the government has intervened by imposing new property taxes, especially on owners of multiple properties. The government intends building 300,000 new homes in greater Seoul to help stabilize the market. The minister responsible has said that if the current measures do not have the required effect, more new measures will be implemented.

11. Phnom Penh

Cambodia's capital city, is at the center of a massive economic expansion. The country's GDP hovers are almost 7%. Much of the growth is fueled by foreign investment from Japan, China, and other countries. The real estate market, especially for land, looks positive in the short term. But there appear to be underlying problems.

The growth is not organic but fueled by outside investment. Many new homes are not in keeping with Cambodian culture, and so do not appeal to many citizens. The urbanization far exceeds the much-needed infrastructure so water supply, wastewater treatment, transport, etc. have all fallen well behind. In addition, since Cambodia's traditional banking laws are weak, and many wealthy Chinese are paying cash for the new apartments, the government fears that the purchases may be driven by money-laundering tactics. The net result, in the foreseeable future, may well be later investors will be the ones to suffer.

12. São Paulo

SP is the last city we will look at. Brazil's political profile is likely to have a strong impact on the market. The residential market in Sao Paulo shows a stable profile, but with many properties out of reach for many residents. Foreign investors bought a lot of homes, and they are now treated as squats by illegal occupiers. They say it is partly because they cannot afford the rents, and partly to protest the market in general. Inflation rates do not help affordability, which vary wildly. In 2012, inflation was 5.4% and peaked at 9.03% in 2015. Ultimately, the inflation rate has fallen to 3.5% in 2018. With excessive inflation, real price gains are much less than they would appear at face value.

The extensive corruption scandal, "Operation Car Wash", has had a chilling effect on the country, pushing it into one of the worst recessions ever. Elections in October signal political and market uncertainty, as many politicians are not well received. With interest rates at 6.5% and inflation at a 15 month high, rental property investors may choose to avoid jumping in for some time.

Final Comment

Choosing a city to buy rental properties encourages either brave speculation or balanced consideration. Some cities have over-priced properties and some well-priced. Some have a history of earning investors good incomes, have low taxes, and encourage investors from all over the world. Some cities and national governments discourage non-resident investors and inhibit both the pre-tax yield and the post-tax earning potential.

Looking closely at the opportunities leads many investors – first-time and seasoned – to choose American cities, especially New York and Miami when looking to best cities to invest in real estate.

Real Estate Investment News:

"Why To Invest In Manhattan Real Estate"

"Top 5 Reasons to Invest jn Real Estate"

"Excellent First Offering Prices at Lantern House Condo"

"US Tax Reform Effects on Real Estate Investors and Home Owners"

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)